Shop

-

Effectively Lead Gen Z: Engage & Retain the New Workforce

May 8, 2025, 1:00 pmIn our 60-minute program, you’ll discover how to lead Gen Z employees with strategies that increase productivity, reduce turnover, and build a more cohesive and motivated team. -

Taxing Fringe Benefits: Avoid Costly Mistakes & Stay Compliant in 2025

May 6, 2025, 1:00 pmIn our 60-minute program, you’ll discover how to safeguard your organization from costly compliance errors, improve payroll accuracy, and confidently manage the taxation of fringe benefits. You’ll walk away with practical, immediately applicable skills to ensure proper classification, reduce tax liabilities, and prevent penalties. -

Government Workforce Cuts in 2025: What It Means for Your Business & How to Adapt

April 17, 2025, 1:00 pmIn our 60-minute program, you’ll discover how to proactively prepare your business for government workforce reductions. You’ll walk away with clear strategies to assess your risk, adapt operations, and explore new revenue opportunities—ensuring your organization remains strong despite economic shifts. These insights will help you make informed decisions, improve business performance, and secure long-term growth. -

Managing Leave for Your Multi-State Workforce

April 10, 2025, 1:00 pmIn our 60-minute program, you’ll discover how to confidently manage multi-state leave policies while reducing compliance risks and administrative headaches. With practical guidance and real-world examples, you’ll leave equipped with immediately applicable strategies that streamline processes and protect your organization from costly fines. -

Navigating Child Support Garnishments in 2025: Stay Compliant & Avoid Penalties

April 15, 2025, 1:00 pmIn our 60-minute program, you’ll discover how to confidently process child support garnishments while reducing compliance risks and administrative burdens. By implementing these best practices, payroll professionals can improve accuracy, avoid penalties, and enhance employee trust. With clear, actionable strategies, you’ll leave this session with the skills needed to streamline payroll processes, ensuring compliance and efficiency from day one. -

Conducting Workplace Investigations: Protect Your Company, Avoid Costly Mistakes

April 8, 2025, 1:00 pmIn our 90-minute program, you’ll discover how conducting thorough and compliant workplace investigations can protect your organization from legal liability, enhance employee trust, and create a more accountable workplace culture. The skills you gain will allow you to immediately implement best-practice investigation procedures—ensuring every case is handled with consistency, professionalism, and legal compliance. -

FMLA, ADA & Workers Comp: Navigating Overlapping Regulations

In our 90-minute program, you’ll discover how FMLA, ADA and Workers Compensation regulations and requirements can overlap, and how to maintain compliance with each. -

IRS Rules for Reimbursing Employees in 2025

In this information-rich program, you’ll learn which expenses you can reimburse for remote or on-suite employees, reporting and taxation requirements, plus cost implications for your organization. -

Interviewing Dos & Don’ts: What to Ask, What to Avoid in 2025

In this engaging, 60-minute event you will learn how to make the most of interviews to attract and hire the best people for your organization’s current and future needs by asking carefully crafted questions. -

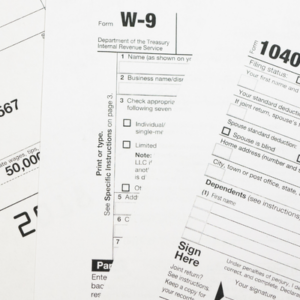

W-9 Form Processing for 2025: Vendor Set Up & Tax Classifications

In our 75-minute program, you’ll discover how to apply the latest W-9 processing techniques to improve your organization’s compliance and vendor management. You’ll gain tools to reduce the risk of penalties, prevent fraud, and streamline your W-9 handling processes. -

Creating Payroll Procedures: Cut the Complexity, Boost Compliance

In our 60-minute program, you’ll discover how to turn the process of writing payroll procedures into a streamlined, impactful project that enhances both team efficiency and compliance. You will leave with actionable tools you can implement immediately, reducing stress and delivering measurable results in payroll performance and operational clarity. -

Multi-State Taxation for Remote Workforces in 2025

This 60-minute program delivers in-depth guidance on navigating multi-state and local tax regulations for remote workforces, ensuring compliance and accurate taxation.